Aging Challenges in America & How to Overcome Them

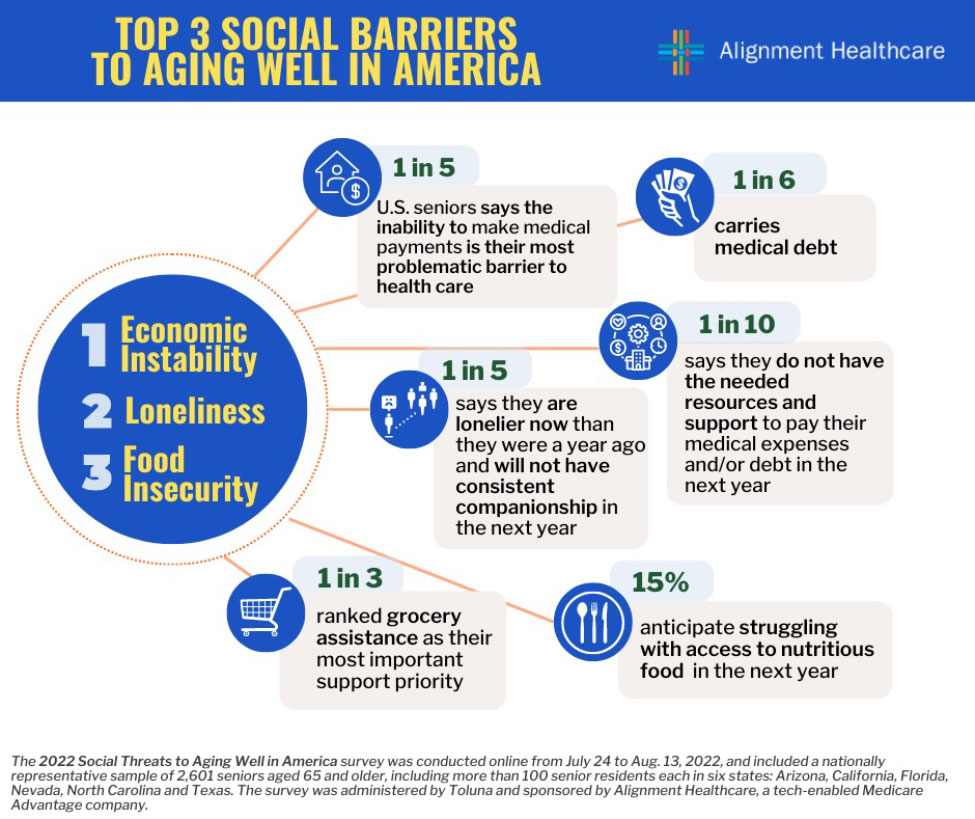

Aging gracefully in America is a goal many seniors strive for but often encounter significant social barriers that hinder their well-being. The “2022 Social Threats to Aging Well in America” study conducted by Alignment Healthcare sheds light on three primary challenges: economic instability, loneliness, and food insecurity. These factors not only impact the quality of life but also the health of many older adults across the nation.

Economic instability is a pressing concern for many seniors. 1 in 5 seniors in the United States struggle with the high costs of medical care, which represents the most significant barrier to accessing necessary health services. Additionally, 1 in 6 older adults carry medical debt on top of other financial obligations. With many living on a fixed income, 1 in 10 older adults report that they lack the resources to cover their bills and medical expenses, leading to compounded stress and health issues.

Loneliness

Social isolation and loneliness are severe problems affecting older adults, exacerbated by modern societal structures. 1 in 5 seniors report feeling lonelier now than they did in the past, and many anticipate a future without consistent companionship. Aside from just the companionship element, many older adults struggle with the unknown of their future care when they are no longer independent. As families live farther apart and increasingly rely on technology for communication, those not proficient with digital tools find themselves further isolated. This detachment not only affects their emotional health but also has tangible impacts on their physical well-being.

Food Insecurity

Inflation has dramatically affected the ability of many Americans to afford essential goods, including food- especially high-quality food. This impact is felt even more acutely by older adults, who often have less flexibility to adjust to rising costs due to fixed incomes. 1 in 3 seniors highlighted grocery assistance as their top support priority, reflecting the dire need for access to nutritious and affordable food. 15% of older adults anticipated future struggles with obtaining adequate nutrition, highlighting the need for effective interventions.

While facing these challenges can be daunting, it is helpful to know what they are so that we can begin to strategize on how to overcome them. Regarding economic instability, loneliness and food insecurity, here are some recommendations on how best to tap into resources that can greatly assist with these pain points:

- Contact your local elder services organization. ABC is proud to partner with many of the elder service agencies across the Commonwealth. We can tell you for sure that there is no better place to start when it comes to identifying resources and understanding your options than your local elder service agency!

- Speak with a trusted Financial Advisor who can help address any concerns you may have about your finances. Especially when it comes to planning for future care and gauging the cost implications of care options, Financial Advisors play a critical role in not only helping you truly understand your options but also the feasibility of being able to afford said options. These Financial Advisors can also help you conquer any existing debits that you have that may be overwhelming by making recommendations on which debts are best to pay off first etc.

- Consult an elder law attorney to inquire about Medicaid Planning and/or understand how a Frail Elder Waiver could help you decrease medical expenses (so that you are not adding onto existing debt) as well as assist you in affording necessary care in the future. Just as you would go to a specialist for heart surgery and not your generic Primary Care Physician, the same goes for attorneys- they are not all created equal! Elder Law Attorneys are specialized in helping older adults plan for their future, including wealth preservation, asset protection and means of care. They are well-versed on the many kinds of trusts there are and how to structure your estate so that all that you’ve worked for can actually work for YOU! Especially when it comes to helping an individual qualify for Medicaid so that they can subsidize costly medical expenses through state-funding, there are many legal factors that must be considered, and no one will be more knowledgeable on this topic than an Elder Law Attorney.

- If you own a home and you’re in a tight spot, financially, Reverse Mortgages can help. Reverse Mortgages allow homeowners to tap into the equity of their home (if they have enough equity) to help them pay off insurmountable debt or to help them afford care. While they have a bad reputation because of scenarios that happened in the past, the qualifying criteria for these reverse mortgages have come so far and truly exist to protect the homeowner. If you are interested in learning more about Reverse Mortgages, you will want to speak to a reputable bank or lender to explain these in more depth to see if this is a good creative financing option for you!

- When it comes to affording care, Long-Term Care Insurance Policies as well as Veteran’s Aid and Attendance Benefits can help ease the financial burden! If you have a long-term care insurance plan, consider yourself one of the lucky ones. You planned ahead and now you get to reap the benefits of that fast-forward planning! While every long-term care insurance policy is different, these policies help you afford the care when you need it! Start utilizing your policy to avoid paying increasing monthly premiums! Also, if you are a veteran and served in the military, you (and your spouse) are eligible for exclusive benefits such as Aid and Attendance which helps subsidize the cost of home care. Speak with your local Veteran’s Services Officer for more information (Veteran’s Services Officers are usually located at your COA/Senior Center or Town/City Hall).

- Learning something new is actually a good thing- especially when it helps you connect with family and friends! New and advanced technology can be intimidating but if you must rely on technology to connect with your loved ones, it’s worth it to learn how to use Zoom, Google Meet, FaceTime, social media, email etc. In a pinch and need help? Best Buy’s Geek Squad is a great place to start! You can visit them in-store as a “Walk-In” or easily make an appointment online and schedule a session with one of their representatives who can show you how to operate something on your cellphone or computer or fix something if you are experiencing any issues with your device(s). Alternatively, many Councils on Aging (COA)/Senior Centers host regular IT classes as part of their monthly programming. If you haven’t been to your local COA/Senior Center, visit them online or stop by to grab an activities schedule. This is a great opportunity to learn a new skill for FREE!

- Get involved with your community! Your local COA/Senior Center is the best place to start when it comes to getting out of the house and socializing. If you haven’t inquired before, these COAs/Senior Centers have incredibly robust activities calendars and truly offer something for everyone. There is no fee to go to your COA/Senior Center and you are not obligated to attend any of the events/activities unless it is something you are interested in. Aside from COAs/Senior Centers, there are many local groups in your community that you could join from church groups, book clubs, gardening clubs, conservation committees, volunteer opportunities etc. Not only would you be socializing and meeting new people, but you could be making a difference as well!

- Find Part-Time Employment. With increasing costs of living, it has become even more challenging for older adults to truly retire. Aside from the financial aspect, many older adults in retirement find themselves seeking opportunities that will help give them a renewed sense of purpose. Finding part-time employment can also help with introducing you to new people who could very well become new friends! Other than the favorable financial benefits and boost in self-esteem, part-time employment also helps with combating isolation in older adults. Many older adults even enjoy part-time work that provides them with rewarding experiences such as working in home care and being a companion for seniors. ABC is hiring so if you or someone you know may be interested in being a homemaker or companion for a senior in your community, apply online or reach out to us directly at 781-245-1880- we would love to chat with you!

- Consider Adult Day Health Programs. Though Adult Day Health Programs wouldn’t be as ideal for an older adult who is independent, they are great avenues for socialization for seniors who require personal care and cognitive assistance. Adult Day Health Programs are reasonably priced and are safe environments with care on-site that provide daily activities to promote socialization and combat isolation for seniors who would appreciate a change of scenery. Some even offer transportation and meals (breakfast and lunch) for their attendees!

- Having trouble affording food? Tap into community resources! We have mentioned the COAs/Senior Centers a lot but it is only because they provide so much and are the answer to many of the problems that seniors have. COAs/Senior Centers often offer very cheap breakfasts, lunches or dinners on a regular basis that you can sign up for ahead of time. It is a good way to not only enjoy a good meal but enjoy a good meal with great company! If you need a more long-term solution, it may be worth inquiring with your local elder service agency about Meals on Wheels. Countless seniors have benefitted from the weekly Meals on Wheels deliveries and, if you qualify, this would be the peace of mind you’re looking for as far as knowing you will always have a good meal and it won’t break the bank! The Supplemental Nutrition Assistance Program (SNAP) also exists to help an individual buy food each month. Your local food pantry, food stamps and EBT cards are other alternatives as well.

- While they used to be considered “luxury,” meal service plans may actually wind up being cheaper than the cost of your weekly grocery trip! Depending on the meal service you sign up for and how much (on average) your weekly grocery trips cost, you may be able to save money on a weekly meal delivery service versus going to the grocery store and spending money on all the ingredients for one or two meals. It will take some work, on your part, to price this out and gauge if this would be a feasible option for you or not but meal service plans can provide more than good, reliable meals…it also means less work for you as now you don’t have to worry about cooking the meals or having the ingredients you bought go to waste!

The good news? Resources are available, it is all about knowing where to start when looking for information. At ABC, we are more than a home care agency- we are your aging hub and can help provide the guidance and information you need to succeed in living safely and independently at home!

#agingwell #seniorhealth #economicinstability #endloneliness #foodsecurity #seniorsupport #healthcarecosts #inflationimpact #nutritionforseniors #socialbarriers