Make the Most of Your Retirement

Make the Most of Your RetirementMake the Most of Your RetirementThanks to modern medicine and other health resources, Americans are living longer than decades prior. Not only are older adults living longer but they are able to maintain a good quality of life throughout their golden years due to the increased availability of durable medical equipment, innovative medications and therapies that assist in treating chronic illnesses and symptoms, as well as health-related services like home healthcare which helps with personal care and more to help individuals remain living safely and independently in their homes. While all of this is good news for the aging population, there is one downfall…many older adults haven’t planned accordingly to save enough money to sustain them post-retirement.

The statistics are staggering…

- 79% of retirees depend on Social Security to live

- During retirement, older adults outspend their annual income by more than $4,000 on average

Your Guide to Money-Saving Benefits in Retirement (ncoa.org)

…however, they tell us that the time is NOW to start evaluating our financial wellness and start implementing small changes that can make a big difference in the long run. To lessen financial stress during retirement, you may want to consider the following:

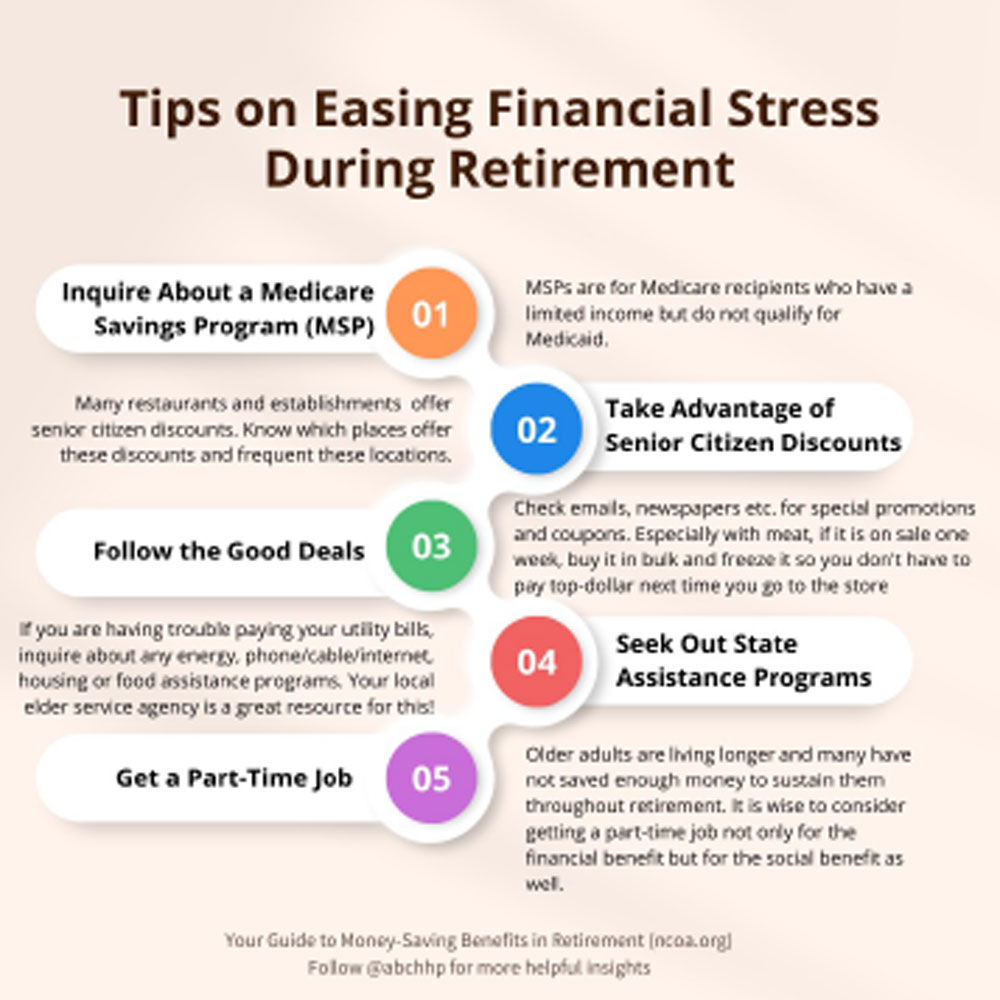

Medicare Savings Programs (MSPs)

Healthcare in the US is expensive and as the costs of co-pays, deductibles and prescription costs continue to rise, you may notice you are struggling with affording these expenses. If this is the case, you may want to speak with a Medicare professional regarding Medicare Savings Programs (MSPs) as these programs are designed to assist Medicare recipients who are operating off of a limited income but do not qualify for Medicaid. Medicare beneficiaries may also qualify for Medicare Extra Help depending on income and asset eligibility.

Senior Citizen Discounts

Many restaurants and establishments offer senior citizen discounts. If you are planning on going out to eat or participating in an activity, it never hurts to call the location before you go to see if they offer discounted senior pricing. While it is not exhaustive, here is a list of many restaurants, retail stores, grocery stores and more who offer senior discounts.

Follow the Good Deals

While getting emails from stores and restaurants can be annoying at times, they can be useful when it comes to alerting you of special deals and promotions they are running. Remember, we are just making a comeback from the pandemic so these stores and restaurants WANT to do all they can to get you to dine and shop!

Though many people rely on websites such as Groupon to browse deals, don’t underestimate the power of a flier, circular or mailed coupons! Especially when grocery shopping and buying meats, if the meat is on sale, you may want to consider buying it while it is on sale and freezing the excess for you to have later so that you don’t have to pay top-dollar next time you need chicken or beef or whatever else you like to eat!

Seek Out State Assistance Programs

Inflation has made the cost of everything go sky-high! If you are experiencing difficulty paying for food, housing, electricity, heat, or any other utilities, help is available!

Local elder service agencies such as Mystic Valley Elder Services, AgeSpan, SeniorCare Inc., Greater Lynn Senior Services and Minuteman Senior Services are invaluable resources when it comes to learning about what programs exist, each program’s eligibility criteria and the details of the application process. Don’t be ashamed to ask for help when you need it- this is what these organizations are here for!

Get a Part-Time Job

You’ve earned the right to not work in retirement but if you are finding it hard to pay your bills, it might be a good idea to consider getting a part-time job to help bring in some extra cash! Is there something that you’ve always wanted to do or a place you enjoy going to that you will think you like working at? Even just a few days or working a couple of hours a week can help off-set expenses if you use this cash as your spending money and take money from your savings to cover the other expenses you have coming in.

Keep in mind that re-entering the workforce part-time doesn’t just have financial benefits- it has social benefits too! You have the opportunity to get out of the house, make some new friends and make a difference!

While the above are all helpful tips, we strongly encourage that you speak to a qualified financial professional for further guidance on making the most of your money. Don’t have a certified public accountant (CPA) or trusted financial advisor? Your friends at ABC can help by pointing you in the direction of our preferred contacts! Email us anytime