Understanding Social Security: When to Take Your Benefits

There is a lot of confusion around social security, however, it is important to become educated on this topic if you are of age and eligible to claim your benefits or if you could become eligible soon. Understanding when and how to take your social security benefits can greatly impact your financial stability in retirement. Here is a quick guide to help answer some frequently asked questions and offer some tips on how to make the most of your benefits:

Timing is Everything

Wait if you can: The longer you wait to claim your social security benefits (up to age 70), the more substantial your monthly payments will be. Wondering what your full retirement age is? Click here to find out. Patience really can pay off!

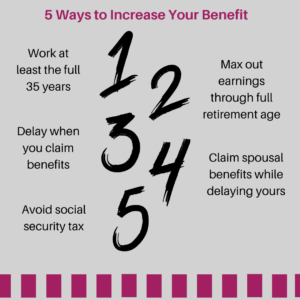

Maximizing Your Benefits

Strategic Planning: Consider your overall retirement plan, health status and financial needs before deciding when to take your benefits. It is important to note that, if you are 65 years of age or older, receiving social security benefits requires you to enroll in Medicare Part A if you are claiming or planning to claim benefits. Therefore, if you or your spouse is still working and receiving health insurance through the employer, you may not want to enroll in Medicare which means you wouldn’t be able to claim your social security benefits.There are also a few tax considerations you need to know about:

- The first 15% of benefits are NOT taxed but any additional benefits may be partially taxable if your combined income exceeds certain thresholds

- Keep in mind that you will lose less of your social security to taxes if you are in a lower tax bracket when you begin to collect your benefits

- During the year when you reach retirement age, your benefits will be reduced by $1 for every $3 in income over $56,520 in 2023 until the month you become fully eligible

It is recommended that you meet with a reputable, licensed financial advisor or wealth management professional to ensure that your strategy lines up with your goals.

Spousal Benefits: The highest spousal benefit that can be claimed is half of the benefit that their spouse is entitled to at their full retirement age. While it is beneficial for a recipient to wait until 70 years old to claim social security benefits, spouses will not get a larger spousal benefit if they wait to claim benefits. Also, when one spouse dies, the surviving spouse is entitled to the higher of their own benefit or their deceased spouse’s benefit.

Stay Informed and Prepared: Keep abreast of changes in social security policies and understand how any changes may affect your benefits. The Social Security Administration (SSA) has over 300 posts in over a dozen categories and presents these “hot topics” in a concise, digestible article; and they continue to add more! Sign up on their website to stay up to date on tools, benefits and online services. Knowledge is power!

Clearing the Confusion

What You Need to Know – Social Security FAQs

Q: How do I apply for social security benefits?

A: You can apply for benefits online, by phone or at your local social security office.

Q: Can dependents of someone getting social security receive benefits?

A: In some cases, social security also offers benefits to qualified dependents of a recipient. Eligible dependents are spouses, ex-spouses, dependent children or grandchildren or dependent parents. Dependents may receive anywhere from 50%-100% of the benefits if a recipient retires, becomes disabled or dies.

Q: Is it possible to collect social security benefits from two different spouses?

A: Yes. Notify the SSA that you were married more than once and that you may qualify for benefits on more than one spouse’s earning record. You will be advised which record offers the higher pay-out.

Q: What happens if my spouse didn’t work at a job or doesn’t have enough credits to qualify for social security on their own?

A: In this case, this person is eligible to start receiving benefits at age 62 based on their spouse’s record.

Q: Will the SSA ever contact me by phone?

A: NO! If there is an issue with your social security number or account, you will receive a formal letter in the mail. The SSA will only call you if you have specifically requested a call. Therefore, if you did not request a call from them, it is likely a scammer so hang up right away!

Resources are Available- Use Them! If you are confused, contact a representative at the Social Security Administration (SSA) for clarification- you can submit an inquiry online, call the SSA directly at 1-800-772-1213 or visit one of their local offices. The SSA’s website is the best FREE resource when it comes to everything that has to do with social security.

It is our hope that this information has been helpful and has provided you with a better understanding of social security. Remember…informed choices lead to a better retirement!

#SocialSecurity #RetirementPlanning #FinancialWellness #SeniorLiving

_________________________

ABC Home Healthcare Professionals is a home care agency and does not specialize in financial services or financial advising. The information in this post has been taken from multiple sources and is being shared for informational purposes only. All information provided should be verified and further explained by a duly licensed financial professional or the Social Security Administration.

The following sources are credited for all the information provided:

-

Fontinelle, A. 2023, February 19. When To Take Your Benefits. Investopedia: Retirement Guide – Define Your Dream, p 64-67. (investopedia.com/retirement/when-take-social-security-complete-guide/)

-

Best, R. 2023, October 18. 5 Tips to Increase Your Social Security Check. Investopedia: Retirement Guide – Define Your Dream, p 96. (https://www.investopedia.com/articles/retirement/081616/5-tips-increase-your-social-security-check.asp)

-

Frequently Asked Questions. Social Security Administration. https://faq.ssa.gov/en-US/

Investopedia does not provide tax, investment, or financial services and advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal. Investors should consider engaging a financial professional to determine a suitable retirement savings and investment strategy.

If you are in need of a qualified financial professional, ABC can provide recommendations but make no warranties or representations. To contact the Social Security Administration, you can call them via telephone at 1-800-772-1213, you can email them via this link: https://secure.ssa.gov/emailus/, or you can visit a local Social Security office near you. To locate Social Security offices in your area, visit: https://secure.ssa.gov/ICON/main.jsp